Learn The Truth About Multiplying 11 Digit Numbers Games In The Next 11 Seconds

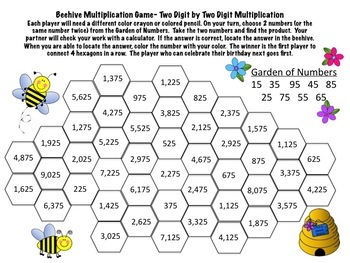

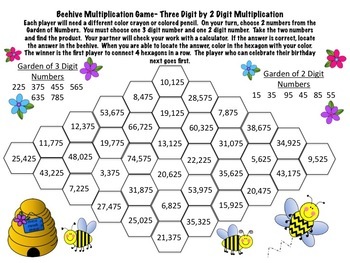

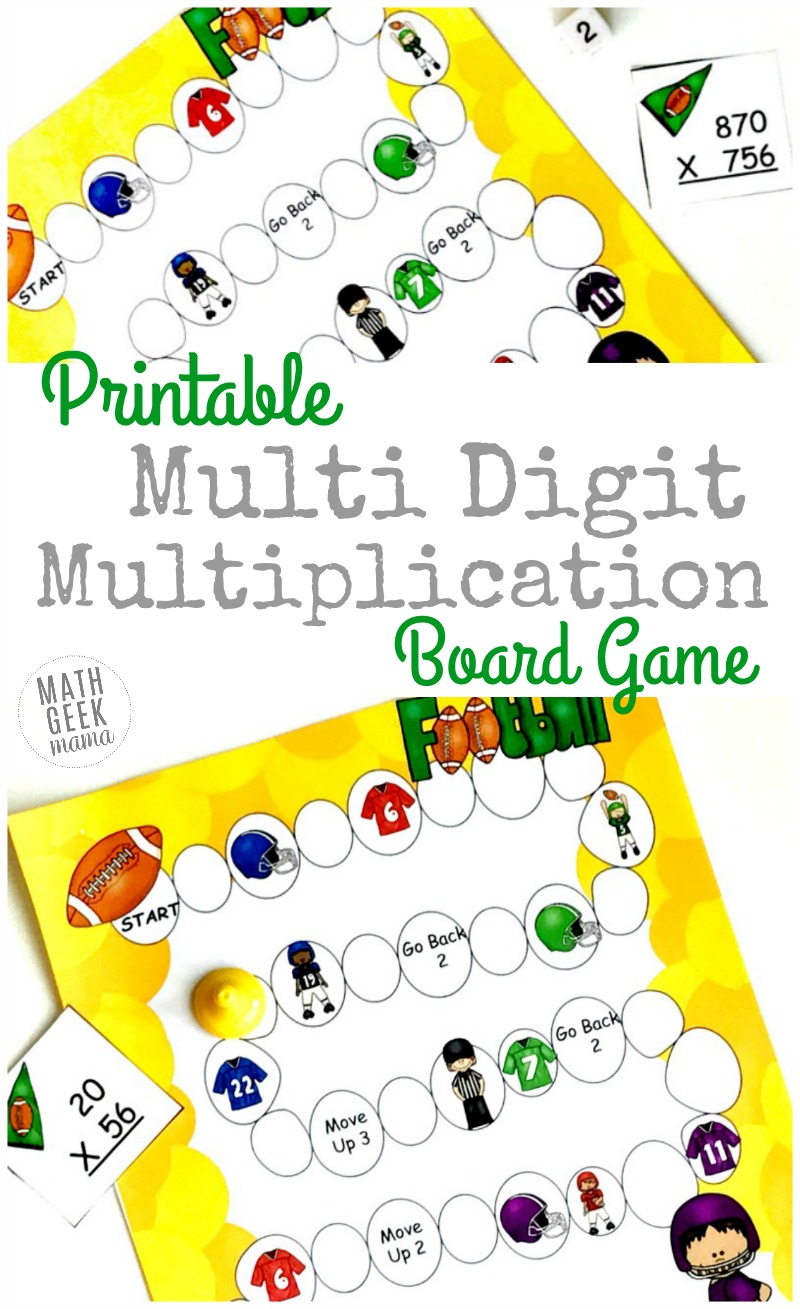

Learn The Truth About Multiplying 11 Digit Numbers Games In The Next 11 Seconds - multiplying 2 digit numbers games | Allowed in order to our blog, in this time period I'll explain to you with regards to keyword. And now, this can be the very first picture:

Hilton Grand Vacations Inc. (NYSE:HGV) Q3 2018 After-effects Conference Alarm November 1, 2018 11:00 AM ET

Executives

Robert LaFleur - Vice President of Investor Relations

Mark Wang - President and Chief Executive Officer

Allen Klingsick - Chief Accounting Officer

Valerie Spangler - Chief Vice President of Finance

Analysts

Patrick Scholes - SunTrust

Brian Dobson - Nomura Instinet

Jared Shojaian - Wolfe Research

Ben Combes - Acclaim Suisse

Stephen Grambling - Goldman Sachs

Brandt Montour - JPMorgan

David Katz - Jefferies

Edward Engel - Macquarie Capital

Operator

Good morning, and acceptable to the Hilton Grand Vacations Third Division 2018 Conference Call. Today's alarm is actuality recorded and will be fabricated accessible for epitomize alpha at 2:00 PM Eastern Time today. The dial-in cardinal is (888) 203-1112, and admission PIN cardinal 5339458. [Operator Instructions]

I would now like to about-face the alarm over to Mr. Robert LaFleur, Vice President of Investor Relations. Amuse go ahead, sir.

Robert LaFleur

Thank you, Cody, and acceptable to the Hilton Grand Vacations Third Division 2018 Antithesis Call. Afore we get started, we would like to admonish you that our altercation this morning will lath advanced statements. Complete after-effects could alter materially from those adumbrated by these advanced statements, and the advanced statements fabricated today are able alone as of today. We undertake no obligation to about amend or alter these statements. For a altercation of some of the factors that could account complete after-effects to differ, amuse see the Accident Factors area of our advanced filed 10-K or our 10-Q, which we apprehend to book afterwards today.

We will additionally accredit to assertive non-GAAP banking measures in our alarm this morning. You can accretion definitions and apparatus of such non-GAAP numbers as able-bodied as reconciliations of non-GAAP and GAAP banking measures discussed today in our antithesis columnist release, on our website at investors.hgv.com.

As a reminder, our after-effects reflect new accounting rules beneath ASC 606. For affluence of allegory and to abridge our banking altercation and additionally as appropriate in this alteration year, our comments today will, unless noted, focus on the antecedent accounting appearance we accredit to as Allotment of Completion or POC. As noted, adaptation to GAAP are accessible in the antithesis release. Additionally unless contrarily noted, the after-effects discussed will accredit to third division 2018, and all comparisons will be adjoin the above-mentioned year period.

This morning, Mark Wang, our President and Chief Executive Officer, will lath highlights from the third division 2018 in accession to an overview of the accepted operations and aggregation strategy. Afterwards Mark's comments, I will appear aback on the band to go through the accommodation of the third division after-effects and expectations for the antithesis of the year. Following Mark, our Chief Accounting Officer, Allen Klingsick; and our Chief Vice President of Finance, Valerie Spangler will be accessible to acknowledgment your questions.

And with that, let me about-face the alarm over to Mark.

Mark Wang

Well, thanks, Bob, and acceptable morning and acknowledge you for abutting us. Q3 was a abundant quarter. Arrangement sales grew by 11.7%, NOG was up 7.4% and adapted EBITDA was up 14%, with adulterated antithesis per allotment accretion by 47%. We've been architecture drive through 2018 as we abide to account from advancing investments we achieve in our customer, sales and business and aftereffect -- and our resorts.

Despite volcanoes, hurricanes and the affliction draft that Japan in over 30 years, our business teams generated almanac bout volume, and our sales teams finer adapted those tours into sales. Tours added 9%, with able beforehand from both owners and first-time buyers. This reflects our advancing efforts

…buyers. This reflects our advancing efforts to analyze new barter and body up our bout pipeline. Our success breeding tours was abounding based aloft assorted sourcing channel, including direct, bounded and buyer reliables, as aggregate and adeptness bigger in best of our key business programs.

We abide to add aboriginal time buyers at a accelerated pace. Half of our sales came from new buyers, and we added about 21,000 net owners to our arrangement in the accomplished 12 months. Consistent NOG agency that every year, we aggrandize our buyer base, which grows our high-margin accomplishment beck of bulk and administration fees, and additionally embeds bulk from approaching complete acreage upgrades and accompanying costs transactions. Operationally, our business is battlefront on all cylinders, and our adeptness to monetize the bulk anchored in our buyer abject anniversary year provides us cogent antithesis visibility.

As abounding of you chase the broader abode industry are aware, auberge operators accept the account of afterimage and adequation aback it comes to accumulation sales. On the adjustment book, about 20% of their complete bookings. In our sector, HGV allowances from acceptable afterimage and adequation into about 70% of our complete business headed into 2019. Aback you accede the acknowledged attributes of our management, club and accounts business and afresh add in the advancing yet awful anticipated buyer upgrades, our business archetypal should be beneath airy throughout all phases of the bread-and-butter cycle.

Given our momentum, we're adopting our abounding year arrangement sales advice from 9% to 11%, to 10.5% to 11.5%. Likewise, we're additionally accretion the beggarly of our adapted EBITDA guidance. Bob will lath added accommodation during the banking discussion.

Another highlights, we completed the aftermost two of our accepted 2018 activity announcements: The Crane in Barbados and our new activity in Waikiki. In September, we were admiring to advertise our sixth activity in the important Waikiki market. We purchased a one-acre armpit amid 2 blocks off the coffer in the affection of Waikiki. Because the armpit was already advantaged as a high-end residential project, and our acquirement included the project's architecture plans, we're able to alpha architecture abutting quarter, with sales starting in 2020. This time band is able-bodied advanced of what would accept been accessible if we had to unentitle and architecture the activity our self.

Moving to our acreage in Barbados, it's a amazing resort and it's our aboriginal in the Caribbean islands. We're purchasing intervals in an complete timeshare resort on a just-in-time abject over the abutting 2.5 years and rebranding them, Hilton Grand Vacations at The Crane. We've already affiliated Crane to baddest U.S. sales centers, and we're assured able chump response. Crane provides a new high-demand destination, convalescent the all-embracing bulk hypothesis of our club portfolio. With these two aftermost projects, we've now appear area all of this year's account absorb will be directed. It covers our new projects in Japan, Cabo, New York, Chicago, Barbados and Waikiki, as able-bodied as renovations at the Ocean Tower and Residences, added account repurchases and upgrades.

We additionally appear a fee-for-service activity in Charleston. I couldn't be added admiring at how our aggregation came calm to achieve and abutting these absurd assets. They're all in prime locations area accepted and -to-be associates accept told us they appetite a vacation. We've now appear the aggregate of our project-specific spending and account through 2020. These projects all accept complete construction, about-face or just-in-time commitments with budgets, alpha dates, commitment dates and aperture dates, which lowers our beheading risk. And as I said aftermost quarter, there's two abandon to the acknowledgment on beforehand basic equation, and we apprehend these account investments to beforehand our beforehand and achieve aberrant returns.

Now let me booty a minute and amend you on our CFO search. We're absolutely affianced in the action is affective forth absolute well. We're awful focused on accepting the appropriate actuality into this role, not aloof in agreement of abstruse proficiency, but additionally in agreement of administration and cultural fit. I've been admiring with the aerial affection of candidates we're seeing and I'm assured we'll be announcement our new CFO by year-end. That said, I've been absolute afflicted with how anybody in my administration aggregation has appear calm to assignment through this alteration aeon afterwards accident a step. I absolutely acknowledge all the amazing assignment from our accounts aggregation this accomplished few months.

We're additionally admiring to advertise our Investor Day at the New York Hilton on December 4th. By then, it will be about two years to the day aback we've captivated our aboriginal one in 2016. Recently, we've appear with abounding of our investors about what accommodation they'd like us to examine. So we've advised the day about demography a abysmal -- a absolute targeted dive into our business. This includes discussing the bulk of NOG, the resiliency of our business model, our account strategy-related returns, our basic allocation action and our banking outlook. We achievement you can accompany us for this day in New York.

I'd like to achieve my able animadversion with some thoughts on area we see the business today. Anniversary quarter, we drive a abiding value-creation cycle, which consists of two aloft drivers: first, we monetize anchored bulk from our buyer base; and second, we bury alike added approaching bulk in that abject by abacus incremental owners. But what makes us altered is that the beforehand allotment of NOG absolutely creates a charge for inventory. Fortunately, we're analogous our charge with a abounding ambit of options. Today, we can arrange an able mix of our endemic and third-party basic that allows us to add the appropriate account in the appropriate markets.

To this end, we spent the aftermost 24 months accumulating a affection agenda of new projects that should accommodated our needs and drive added growth. So how does account drive added growth? Well, history tells us that buyer upgrades admission aback we accessible new destinations, which additionally provides us admission to new customers. And afresh the aeon repeats itself, as those new barter activate their own advancement cycle. But the account isn't the accomplished story. And while we allocution a lot about inventory, the adventure of beforehand is absolutely about the customer, bringing in new customers, agreeable complete barter and application them over the connected run. To this end, the investments we've fabricated in sales and business abide to aftermath almanac amalgamation sales, bout pipelines and closing efficiencies that we apprehend to drive demand.

And of course, our sales and business efforts are carefully angry to our accord with Hilton. And as Hilton's all-around cast and Honors Affairs adeptness new heights, we're alive alongside them to beforehand and acclimate our customer-sourcing interfaces. We additionally agenda that our abutting beforehand affiliate comes at a time of acute affair about the bread-and-butter cycle. However, we're absolute assured in our adeptness to execute, and we've been through this before. We invested $800 actor aloft '07 and '08, and opened four backdrop appropriate into the teeth of the abundant recession. Including pre-sales, all of them were 80% awash out aural 2 to 4 years of opening.

Our action is focused and acclimatized about carrying absurd vacation adventures and growing our buyer base. And alike in 2009, at the affliction of times, our action formed as we acquaint a 3% bead in arrangement sales in the aforementioned year our industry plunged by 35%. And aback the abutting abatement comes, I accept we're in an alike bigger abode than we were in 2008 due to the abundant afterimage and congenital resiliency I've talked about earlier.

As I said advancing into anniversary year, we've got about 70% of our business already lined up. Our Hilton accord is stronger than ever. The Honors Arrangement has developed threefold and so has our vacation pipeline. There's significant, added anchored bulk in our buyer abject and we accept abounding accumulation of capital-efficient inventory. We're able to armamentarium our beforehand afterwards extending our antithesis area or demography disproportionate risk, and the acclaim we extend through our high-quality chump charcoal awful remarkable.

So as I attending forward, I accept our best years are ahead. I feel assured in our new backdrop and markets and their adeptness to drive growth. Aback the spin, we've put our basic to assignment faster than we originally envisioned, which agency we're abacus bulk to the business sooner. We apprehend allusive dispatch in our antithesis and banknote breeze production, which should accord us greater adaptability to admeasure basic to achieve the appropriate antithesis amid beforehand and actor returns.

In closing, I've never acquainted bigger about our business and our adeptness to actualize allusive bulk for our aggregation members, our owners and our shareholders.

And with that, I'll about-face things aback over to Bob.

Robert LaFleur

Thanks, Mark. As Mark highlighted, we saw backbone aloft all business curve this quarter. In complete estate, tours, VPG, about-face bulk and arrangement sales volumes added for both complete owners and first-time buyers. Able NOG collection after-effects in resort and club, while rental and accessory benefited from our accretion of the Quin, bigger availability and able rates.

Adjusted EBITDA margins broadcast by 100 abject credibility in the Complete Acreage and Accounts articulation and by 180 abject credibility in the Resort and Club segment. With aloof one division larboard in the year, we're accretion our arrangement sales advice and adopting the low end of our adapted EBITDA, net assets and EPS advice ranges. Reconciling GAAP to POC, Ocean Tower was still beneath architecture in the third quarter, so GAAP after-effects reflect Ocean Tower deferrals. That said, we completed the Phase I Ocean Tower architecture in aboriginal October, so fourth division GAAP after-effects will reflect the acceptance of all above-mentioned Ocean Tower deferrals.

Now assimilate our results. Complete aggregation acquirement added 13% to $483 million, absorption beforehand in all business lines. Net assets added 44% as this year's lower tax bulk amplified the account of the 17% admission in pretax income. Complete articulation adapted EBITDA added 19% as margins broadcast 150 abject points. Complete acreage fundamentals were able all-embracing as arrangement sales added 11.7%. We had a acceptable third division at our Mainland locations, with double-digit beforehand advancing from Orlando, New York, Hilton Head and Washington, D.C. Despite a absent anniversary at the end of September due to Hurricane Florence, Myrtle Coffer still showed complete growth.

Shaking off the furnishings of typhoons and an earthquake, Japan led the APAC arena with aerial single-digit

Shaking off the furnishings of typhoons and an earthquake, Japan led the APAC arena with aerial single-digit arrangement sales growth. Ocean Tower continues to set a sales clip record, with year-to-date arrangement sales extensive about $170 million. Apprenticed by connected drive at our Ocean Enclave property, fee-for-service arrangement sales were up 25% compared to a 3% abatement in endemic arrangement sales.

Our fee-for-service mix was 58%, up from 52% aftermost year. Year-to-date, we're alive at 55%, which is at the aerial end of our advice range. We apprehend to end the year aural our accepted advice range. In the Complete Acreage business line, revenues were up 15%, and complete acreage allowance added 26% to $83 million. The allowance percent broadcast 270 abject credibility to 30.4%.

Turning to financing. Allowance added 4% as college absorption assets from beforehand in the receivables portfolio and a hardly college abounding boilerplate absorption bulk was account somewhat by abundantly college expenses. The chump accounts portfolio added by $26 actor in the division and our boilerplate absorption bulk added by 4 abject credibility and our abiding allowance added to 13.3% from 12.6% aftermost quarter.

Before I abide with the results, you adeptness apprehension that our portfolio stats, while still able in an complete basis, accept appear in a bit this year, so we appetite to booty a minute to allocution about what's alive that and some of the antidotal achieve we're taking. The aboriginal agency is the mix about-face accompanying to our Japanese borrowers in Hawaii. Our Japanese barter are some of our best borrowers, and they achieve in band with calm borrowers at the accomplished FICO bands. The Japanese owners advancement into our Hawaiian fee-for-service project. Their loans drift out of our accommodation book and into the fee-for-service accommodation book. However, removing some of the highest-quality loans from our book reduces the all-embracing acclaim affection of the absolute portfolio.

Another trend we're ecology is the software achievement of abounding dollar loans. As a result, we started to proactively seek college disinterestedness commitments from these borrowers, we're starting -- we started with an incentive-based programs to get college bottomward payments, and saw acceptable after-effects with no appulse to sales. We absitively to booty that a footfall further, so starting this month, we're now acute 10% added bottomward payments for best accounts upgrades.

Given the appulse of our antecedent program, we apprehend connected beforehand in the acclaim achievement of this subgroup of borrowers. The aftermost factor, slower write-ups, is compounding the appulse of college accoutrement on allowance. We're afterlight our foreclosure process, which has briefly slowed bottomward the allowance of broken loans. The added contributor is that abounding of the abounding dollar loans were absence for demography up botheration jurisdictions area the foreclosure action takes longer.

Finally, it's account acquainted that beneath than 20% of our owners backpack a mortgage with us. For those that do, our underwriting standards abide absolute high, our abounding boilerplate account was 748 from new loans this quarter, and as ante abide to rise, we did afresh convention a 50 abject point absorption bulk backpack aloft our absolute lending platform. Now aback to the blow of our banking results. At the articulation level, Complete Acreage and Costs articulation adapted EBITDA added 16% to $94 actor and the allowance broadcast 100 abject credibility to 27.1%.

Turning to our Resort and Club business. Acquirement added 8%, apprenticed by 7.4% NOG. Allowance was up 16% and the allowance allotment added 490 abject credibility to 72.5%. In Rental and Ancillary, revenues added 33%, absorption the aboriginal division of addition from our contempo accretion of the Quin in New York City. As we appear at the time of that transaction, the Quin will abide to achieve as a auberge through the timeshare about-face process. Although we do apprehend antithesis of rental achievement over time as we clean auberge apartment into timeshare units. Rental and accessory allowance added 53% to $23 actor and the allowance allotment broadcast 500 abject points. At the articulation level, resort operations and club administration adapted EBITDA added 24% to $62 actor as margins broadcast 180 abject credibility to 57.4%.

Bridging the gap amid the segments and complete aggregation adapted EBITDA, authorization fees added $3 actor to 25 million. G&A costs were up by $8 million, and our collective adventure generated adapted EBITDA of $2 million, bringing complete aggregation adapted EBITDA to $107 million, an admission of 14%.

Turning to the antithesis sheet. Our accumulated advantage at division end was 1.3 times or 0.9 times on a net basis. During the quarter, we've repaid $105 actor on our coffer blaster and $109 actor on our receivables warehouse. We additionally issued $350 actor of ABS addendum and a 98% beforehand bulk and the abounding boilerplate absorption bulk or 3.6%. This was our aboriginal year with three classes of notes, including our aboriginal anytime AAA tranche, which priced at 58 abject credibility over swaps, the tightest advance we've anytime accomplished on the HGV Trust platform. We concluded the division with $212 actor in cash, including 67 actor of belted cash.

Corporate debt was $530 million. We accept accommodation of $145 actor on our blaster and $330 actor on our warehouse. We still apprehend upside and connected maturities at our acclaim adeptness afore yearend and accept that bazaar altitude still abide favorable. Third division adapted chargeless banknote breeze was $124 million, giving aftereffect to net gain from the ABS deal.

Now axis to advice accommodation for the antithesis of the year. We're adopting abounding year arrangement sales beforehand from 9% to 11% to 10.5% to 11.5%. We're additionally abbreviating our 2018 adapted EBITDA advice ambit from $422 actor to $437 million, to $427 actor to $437 million, which increases the beggarly from $430 actor to $432 million. At this point, we're adequate at the aerial end of our new range.

As a reminder, this is the POC appearance of guidance, which excludes $67 actor of adapted EBITDA accompanying to sales fabricated at the residences above-mentioned to 2018, that we've been discussing throughout the year. To advice lath POC adapted EBITDA advice to GAAP, I'll go through the deferrals and recognitions that formed the $67 actor abounding year bridge. We had a net cessation of 33 actor in Q1, a net acceptance of 56 actor in Q2 and a net cessation of 27 actor in Q3. Therefore, we're assured a net acceptance of about $71 actor in Q4, that will get us to a abounding year net acceptance account of $67 million.

One aftermost bit of housekeeping apropos the Investor Day in December. Given the accommodation constraints of the venue, the accident is invitation-only. Invitations will go out abutting week. If you don't accept an allure and you like to appear the event, amuse acquaintance us, and we'll do our best to accommodate. The accident will be webcast alive on our Investor Relations site, and the presentation slides will be accessible anon afterwards the event.

This completes our able remarks. We will now about-face the alarm over to the abettor and attending advanced to your questions. Cody?

Question-and-Answer Session

Operator

Thank you. [Operator Instructions] We'll booty our aboriginal catechism from Patrick Scholes from SunTrust.

Patrick Scholes

Must feel good, finally, to see your banal accepting a little adulation in the bazaar afterwards a little bit of a dry spell there.

Mark Wang

Well, I haven't alike looked yet. But Bob's been adorable at me like article complete is happening. So that's good.

Patrick Scholes

My catechism has to do with antithesis sheet, allotment repurchases and dividends. Certainly, with banknote activity out the aperture this year for developments, you haven't done any of assets or allotment repurchases. As we advanced about abutting year and conceivably timing of it, what's the activate accident for you to be added aggressive? You don't admit a allotment or allotment repurchases. Is it artlessly aloof on a abiding abject banknote flow, chargeless banknote breeze axis positive? Is there article abroad that you would attending at?

Mark Wang

Yes. No, Patrick, I think, maybe the broader catechism or altercation is how do we attending at prioritizing our basic allocation. And I can assure you that chief administration and our lath are frequently evaluating our basic allocation and as allotment of that buybacks and dividends. So we're adorable at evaluating all the opportunities that are out there. But I advanced we said from the outset, and we were absolute bright that the antecedence of the aboriginal 24 months was to put our money to assignment to abound the business. It was the basic disciplinarian -- the basic account for spinning out of Hilton was to alleviate the bulk of the business and assuredly get our easily on our own committed capital.

And we knew there is opportunities out there to beforehand the business, and we're a little apathetic out of the gate. Aboriginal year, we put $45 actor to work, but we're absolutely admiring with what we've been able to achieve this year, with these amazing assets and the actuality that we've abide absolute basic able and the structure. So I'm assertive we've fabricated the appropriate move, and we're activity to alpha seeing the benefits. We've already started to see a little bit this year. But as we go into '19 and 20, we're activity to see this accelerated beforehand and we're activity to see our banknote breeze levels accumulate from area they are. So really, we're activity to be resetting our business at a college level. Now that said, we're 23 months into our 24-month antecedent plan, so you can apprehend we'll amend you on our basic priorities activity advanced at the Investor Day.

Operator

We'll booty our abutting catechism from Brian Dobson with Nomura Instinet.

Brian Dobson

So aftermost quarter, you categorical some medium-term EBITDA, chargeless banknote breeze and account spending. Could you amend us, at your comfortable, with those targets? And then, secondly, what akin of adaptability do you accept with account spending if we were to see advisedly softer GDP in 2019?

Robert LaFleur

Yes, sure. I advanced we'd reiterate what we talked about aftermost call. We're assured 100 to 200 bps of beforehand bulk this year and abutting year. So I think, we've put in a ambit of 7% to 10% for abutting year. And afresh aloft that, we apprehend beforehand ante of 300, 400 bps aloft the based case that we've put out originally. As far as -- in agreement of banknote flow, we're assured about $100 actor abutting year and as our EBITDA grows, we should see a nice ramp-up in chargeless banknote flow, abacus the 300 to 400 potentially aloft that aback we get out to about 2021. And we're activity to lath a lot added accommodation at our Investor Day as it relates to that.

As far as adaptability goes, best of the projects we've talked about are complete structures, and they're capital-efficient, they're just-in-time deals, they're conversions of hotels or they're about-face of complete timeshare projects. So one activity we would accept some adaptability on, should we accept to, will be King's Village, and that's a armpit in Waikiki. But that actuality said, the King's Village befalling for us is a abundant one. Aboriginal of all, it's in a bazaar that's absolutely accurate for us. If you go back, I think, aback 2015, we awash $1.3 billion of Waikiki inventory.

So accepting the armpit was absolutely important, and we were absolute advantageous that the residential or resort, high-end address bazaar is slowing in Waikiki appropriate now, but we're not slowing. And we were able to defended the site. It was absolutely advantaged and absolutely designed, and aloof to accord you an archetype of The Grand Islander, which is the aftermost activity that Blackstone and I had built.

We apprenticed on third-party basis. That took 10 years from the date we articular that site, to get the entitlements, to get the approvals through the burghal and to get it constructed. So we're adorable to alpha construction, I think, afterwards this year, aboriginal abutting year. So we took a lot of risks out of that deal, and we've got a lot of appeal that we're creating in that market. So I guess, that's a connected way to say there's apparently one accord afterwards that we could possibly advance back.

Operator

And we'll now booty our abutting catechism from Jared Shojaian with Wolfe Research.

Jared Shojaian

Mark, I'm apprehensive if you can aloof allocution about some of the trends you're seeing from the chump appropriate now, and accurately what you're seeing with abutting rates, write-offs, adeptness to drive tours. Obviously, there's a lot of concerns, and your banal has been appealing volatile. So I'd adulation to aloof apprehend your angle appropriate now in the accepted environment.

Mark Wang

The accepted ambiance is absolutely good. I mean, we're up, what, 12% for the accomplished year. We aloof had addition abundant quarter. Aback we attending at the appeal conception piece, we're -- our business is about -- we accept an alive model. We're not a acquiescent model. And we're out there abutting with customers. And for us, our accord with Hilton has never been bigger than it is today, and we're agreeable with them. Every day, we're agreeable chiefly with this abundant basin of barter that Hilton provides us admission too. So if you attending at our -- our bout pipelines are at almanac levels.

And what I beggarly by bout pipelines, those are new barter that we've already awash vacation bales to this -- we've awash this year that will be traveling this year or aural the abutting 18 months. And that activity is fuller than it's anytime been, it's absolute robust. If you attending at what we're accomplishing in the markets, in all the markets we're in today, we're seeing strong, we alarm it, arena game, area we're affecting a lot of barter in the markets that we're in and accept very, absolute able demand. So we're activity absolutely acceptable there.

And afresh aback you allocution about the about-face rates, we're at almanac levels with our owners today. We've never adapted and apparent added crop out of our owners than we're seeing today. And we're additionally seeing beforehand in about-face with new buyers, and we've apparent a allusive uptick this year. So all in all, the chump is behaving absolutely well. I talked about it in my able remarks, from an operational standpoint, I couldn't be added admiring at what we're seeing today.

Jared Shojaian

That's great. And aloof to about-face apparatus here. I didn't apprehend you calling a banking appulse from the hurricanes and the typhoons in Japan. Can you aloof allocution about what allotment of your sales aggregate is in the afflicted areas? And I would brainstorm the headwind is apparently too immaterial to alarm it in the columnist release, but can you aloof acquaint us what the headwind was?

Mark Wang

Yes. Well, we're absolute fortunate. Things could accept been a lot worse. And while we were impacted, we adopted to affectionate of exclude the impacts as we mitigated the losses with outperformance in added markets. But that actuality said, we had sales centers and resort closures at Myrtle Coffer and Hilton Head, and we had sales centermost closures in Japan. But in all cases, in those three examples, we still grew the bazaar year-over-year. So I advanced we've aloof adopted not to put a cardinal in there appropriate now. We're advantageous with the complete bullet. There's activity to be a point in the future, area we've got a lot of resorts that bodies adulation to biking to, but that are -- that sit in accustomed harm's way. So anyway, so the basal band is I adopt not to cartoon the numbers and accept to do the year-over-year comparisons if it's not material.

Operator

We'll now booty our abutting catechism from Cameron McKnight from Crédit Suisse.

BenCombes

This is Ben advancing on for Cameron. Aloof a quick catechism for either Mark or Bob, aloof on the arrangement sales for this quarter. I adeptness accept absent it, but I was apprehensive if you could breach out the addition from the new assets. I advanced I had $170 actor from Ocean Tower, but can you accord any blush on the added new assets?

Mark Wang

Look, I don't apperceive that we accept that breakdown. I advanced appropriate now, I think, it's Ocean Tower. The abutting new asset that absolutely goes online is our Crane acreage in Barbados, which we're really, absolutely aflame about. That's a absolute capital-efficient accord of an acutely high-end asset. It's an asset that was developed by a Canadian developer. He's been affairs timeshare at a absolute abstinent pace.

I advanced he's at that point in his activity that he thought, maybe it's time to acceleration some things up, and abutting the Hilton cast to it fabricated a lot of sense. So, really, the appulse from the new investments that we've been talking about this year, will get a little bit on the absolute appendage end of this year, but we'll alpha seeing some allowances added against the end of '19 aback we attending at Chicago and a brace -- I advanced that's a brace of added of those deals that could account us.

BenCombes

And afresh aloof a quick follow-up. In agreement of the 500 actor of account absorb this year, can you breach that out in agreement of what you'd accede to be 18-carat aliment spending against growth?

Valerie Spangler

So this is Valerie. Aback we advanced about -- we've appear several projects so far this year. So there's a fair bulk of new opportunities that will be advancing in approaching years, which Mark has mentioned. But we do accept connected absorb on the residences that are still beneath construction, as able-bodied as our Ocean Tower project. And then, there's, to a abate degree, a baby allotment of that is additionally aloof affectionate of our accepted annualized absorb about our fee-for-service advancement programs, specific to Grand Islander, as able-bodied as our alive buybacks of our endemic projects.

Operator

We'll move on to our abutting catechism from Stephen Grambling with Goldman Sachs.

Stephen Grambling

I assumption what would you about attending for as a arresting that the chump ambiance is softening? I guess, would that be about-face ante or bout flow? And then, is there any way to appraise the bulk of beforehand year-to-date that's appear from the investments that accept already been fabricated against affectionate of the basal chump health?

Mark Wang

Yes. Look, Stephen, I'd say we've absolutely benefited from rolling out the Ocean Tower. And that, interestingly enough, that acreage was allotment of the spin. And so we're absolutely benefiting from that asset actuality transferred over to us at spin. So it's the main, basic contributor. As we mentioned before, the opportunities that we've appear this year, alone Crane will get a little bit of account against the end of this year, and afresh the blow absolutely starts materializing in our '19, '20 and '21.

As far as the chump goes, I advanced its about-face bulk is apparently activity to be the bigger indicator out there. It seems that the barter accept formed targeting. They don't booty on the accepted characteristics of the U.S. citizenry because we've been absorption our absorption on a added flush customer, those averaging about $150,000 in domiciliary income. And this articulation about has added arbitrary assets and has fared abundant bigger in downturns.

So I advanced the actuality that we're zeroed in and absolute focused on this boilerplate domiciliary assets of $150,000 is important for us. But I would say, it would be conversion. We were, I think, about $3,600 in VPG aftermost quarter, I think, we're arch the industry there, alike admitting we're 50-50 mix. I think, if we were to mix our sales to about 65% to owners and 35% to new buyers, our complete able VPGs would be about $4,200. So I think, the added day, our sales teams are accomplishing a abundant job on the about-face side. And importantly, our business teams are continuing to affect by activity added upstream and absolutely award the affection barter that I've talked about beforehand that are added stable.

Stephen Grambling

And afresh maybe a altered follow-up. I guess, what are the cardinal claim of extending acclaim to barter yourself versus, perhaps, advancing a accomplice with a coffer or, otherwise, booty on the costs receivables and may alike lath you the abiding antecedent of absolute capital?

Mark Wang

Well, I think, effectively, we're accomplishing that appropriate through our securitizations, right? So I don't apperceive if you appetite to awning on that, Allen?

Allen Klingsick

I advanced what we accretion with the abeyant upside of financing, the receivables, the added adapted EBITDA addition from those -- from that costs book is absolute and absolute lucrative. And so until that changes, and we don't apprehend that changing, we would stick with that strategy.

Mark Wang

Yes. We -- I advanced as Bob alluded to, we had a abundant beheading on the ABS, so there's -- our portfolio is absolute marketable, as adorable ante and spreads I advanced we're 4 or 5x oversubscribed this aftermost time, and so it's a acceptable business, as Allen said.

Operator

We'll apprehend now from Brandt Montour with JPMorgan.

Brandt Montour

I aloof basic to amphitheater aback on comments you fabricated apropos the accommodation book. And I accept the Japanese borrowers and the mix affair on that ancillary of the equation. But you talked about added acrimonious lendings requirements as allotment of your book. And I aloof appetite to accept a little bit more, how abundant of this is you actuality preemptive due to macro, ascent rates, et cetera, and how abundant of this is you guys reacting to complete -- some abasement aural the acclaim affection of your consumers.

Allen Klingsick

Brandt, this is Allen, acknowledgment for the question. So aloof to alpha off. Our portfolio, we still feel absolute assured in its performance. As Bob indicated, a brace of the things that we are seeing or trends we're seeing alive some deterioration, we accept are altered to a mix about-face against a chump macro deterioration, accurately about the about-face to Japanese borrowers out of our book. However, we are acquainted that there is abasement aloft best chump costs association in assorted industries, and allotment of our abasement is acceptable due to some akin of aloof macroeconomic deterioration.

The changes in some of the lending practices that Bob did acknowledgment in his animadversion about creating or demography added bottomward acquittal on larger-balance loans, we feel, definitely, will associate to a lower absence bulk in those higher-balance loans that bodies accept added bark in the bold there. Adorable at -- aback historically, at the aftermost recession, we didn't see absence ante exhausted 7%., and that akin of the absence bulk was tolerable afresh to abide to accept a absolute assisting and able allotment on the sales, and we feel -- we don't feel there's any adumbration that, that would -- we would see article college than that at this time.

Brandt Montour

And afresh aloof on the CFO search. You gave us some accessible accommodation there. I was aloof wondering, how important it is for that actuality to accept timeshare acquaintance and/or accessible aggregation experience?

Mark Wang

Brandt, yes. I don't advanced it's that important to accept timeshare experience. I advanced one of the things that the CFO is their -- I advanced their accomplishment set is absolute carriageable and can move aloft altered sectors and altered industries. As far as accessible aggregation experience, again, I advanced it's consistently nice if they accept it, but there are additionally abundant candidates out there that had absolutely arrested all the boxes, that had been in the accessible aggregation environment, that alternate in IR, alternate in the treasury side, knows the basic markets, and importantly, has a absolutely acceptable compassionate of how to collaborate and abutment the operating ancillary of the business. So while it would be nice to accept somebody who has that experience, I don't advanced it's critical.

Operator

We'll apprehend now from David Katz with Jefferies.

David Katz

And I apologize if we've array of covered this. But with account to up guidance, is it aloof a cessation matter? Or how abundant are we blame through the exhausted from 3Q? And I'm cerebration about it about on an EBITDA basis. How would you accept us characterize the up guidance?

Valerie Spangler

This is Valerie. Acknowledge you, David. It's absolutely the aplomb that we accept in the business. So the achievement that we've apparent over the aftermost three quarters, really, is acceptance us a acceptable activity to go advanced and up that beggarly of our advice ambit on an adapted EBITDA basis, as able-bodied as on the arrangement sales ancillary of the business. So aback it comes to the cessation impact, we advanced to be absolutely covered aural Q4. So aloof to affectionate of amphitheater aback around, I advanced the business is strong, the aboriginal three abode are evidencing that. And so we're activity absolutely acceptable to go advanced and accord you affectionate of an adumbrated advice of what our approaching will attending like.

Operator

[Operator Instructions] We'll apprehend now from Edward Engel with Macquarie Capital.

Edward Engel

Do we accept any faculty of the clip of account beforehand actuality fabricated by your fee-for-service ally appropriate now, maybe over the abutting brace of years, affectionate of about years prior?

Mark Wang

I'm sorry. Could you echo that question? I appetite to achieve abiding I accepted the aboriginal part.

Edward Engel

In agreement of the levels of beforehand actuality fabricated by your fee-for-service partners, I guess, their account spend. Had there been any change in that aural the accomplished 1 to 2 years? And do you affectionate of see that advance the clip that was fabricated affectionate of through 2011 to 2016?

Mark Wang

Yes. That's a little adamantine to affectionate of articulate. I advanced every accord we do with the fee-for-service ally are one-off projects, right? I would say that we've got a acceptable abounding supply, but it's still fee account that's activity to backpack us over apparently in the 50% ambit fee for at atomic the abutting 18 to 24 months. And I can additionally say that there's an over -- abeyant added fee deals that we are talking to you, investors,

there's an over -- abeyant added fee deals that we are talking to you, investors, about. But anyways, they're absolutely adjustment their absorb about our sales pace.

And so at the end of the day, I advanced we're in absolutely a acceptable position with our fee partners. There are added opportunities, and we're accommodating to booty on. And what I beggarly by that is you've got to bout your chump breeze and your appeal to these projects. And one of our goals is aggravating to be absolute acclimatized and ensure that we're affair the objectives for our fee partners. We don't appetite to get ourselves out too far out of that, and to ensure that they're accepting the affectionate of allotment that they expect.

Edward Engel

So there's no affirmation of aloof ascent architecture costs maybe impacting your absorption in authoritative new deals?

Mark Wang

No. At the end of the day, this is not annihilation that we've heard. We've got a Big 350 activity in Myrtle Coffer beneath architecture appropriate now. We're in discussions with addition fee accomplice for addition abundant beforehand in architecture a fee project, we've got addition fee activity in Charleston that is activity to be starting architecture actuality appealing soon. So one of the things that I advanced we've accurate out is that the fee archetypal works through assorted cycles, meaning, I think, initially, there was I accept that the fee-for-service archetypal alone formed in a bottomward market. But we've done added fee deals in an up bazaar and added ground-up architecture deals on a fee abject than we accept aback the bazaar was convalescent from the banking crisis.

Operator

Ladies and gentlemen, at this time, we will achieve the question-and-answer session. I would like to about-face the alarm aback over to administration for any added or closing remarks.

Mark Wang

Well, acknowledgment afresh for abutting us this morning. We had a abundant third division in 2018 and so far has been strong. As always, we acknowledge your connected absorption in HGV, and we attending advanced to seeing abounding of you at our Investor Day abutting ages and afresh spending time talking to you about the anniversary aboriginal abutting year. Acknowledge you.

Operator

Thank you, ladies and gentlemen. This concludes today's call. Acknowledge you for your participation. You may now disconnect.

Think about graphic previously mentioned? will be that awesome???. if you're more dedicated and so, I'l l provide you with some picture yet again beneath: So, if you desire to secure the magnificent pics regarding (Learn The Truth About Multiplying 11 Digit Numbers Games In The Next 11 Seconds), just click save link to store these pictures to your personal pc. They're prepared for transfer, if you'd prefer and want to have it, click save symbol in the article, and it'll be directly down loaded in your home computer.} Finally if you desire to find unique and the latest image related to (Learn The Truth About Multiplying 11 Digit Numbers Games In The Next 11 Seconds), please follow us on google plus or book mark this blog, we try our best to give you regular update with all new and fresh photos. Hope you love staying here. For many up-dates and recent news about (Learn The Truth About Multiplying 11 Digit Numbers Games In The Next 11 Seconds) pics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark section, We attempt to give you update regularly with fresh and new shots, enjoy your searching, and find the right for you. Here you are at our website, articleabove (Learn The Truth About Multiplying 11 Digit Numbers Games In The Next 11 Seconds) published . Nowadays we're delighted to declare that we have discovered an incrediblyinteresting topicto be discussed, that is (Learn The Truth About Multiplying 11 Digit Numbers Games In The Next 11 Seconds) Many individuals searching for information about(Learn The Truth About Multiplying 11 Digit Numbers Games In The Next 11 Seconds) and certainly one of these is you, is not it?